Zhiyan Zhan released a report: "China Small and Medium-sized TFT-LCD industry Development Trends and Investment Planning Analysis Report" Small and Medium size TFT-LCD (thin film transistor Liquid crystal Display) is a liquid crystal display technology that is widely used in consumer electronics such as smartphones, tablets, and laptops. The basic structure of TFT-LCD is to place a liquid crystal box between two parallel glass substrates, the TFT is arranged on the lower substrate glass, and the color filter is arranged on the upper substrate glass. Liquid crystal displays control the light output of each pixel through thin film transistors (TFT) to achieve advanced visual display. Specifically, TFT-LCD uses electrical signals to manipulate the orientation of molecules within the liquid crystal material and adjust the light polarization state to turn on or off the pixel point to emit light. Compared with the traditional cathode ray tube (CRT), TFT-LCD display has significant advantages such as ultra-thin size, low power consumption and high definition, which makes it widely popular and become the preferred display technology. The current global display technology field, in addition to TFT-LCD, also includes OLED and Mini LED/Micro LED and other advanced display technologies, these technologies are adopted according to different market needs and application scenarios.

Small and medium size TFT-LCD industry classification

Small and medium-sized TFT-LCD can be classified mainly according to the semiconductor material used. Common types include amorphous silicon TFT (a-Si TFT), low temperature polycrystalline silicon TFT (LTPS TFT), high temperature polycrystalline silicon TFT (HTPS TFT), low temperature polycrystalline oxide TFT (LTPO TFT), and Indium gallium zinc oxide TFT (IGZO TFT). Amorphous silicon TFT (a-Si TFT) is the most common type of TFT and is widely used due to its lower cost and mature manufacturing process. Compared to amorphous silicon, low-temperature polycrystalline silicon TFT (LTPS TFT) has higher electron mobility, can achieve higher resolution and faster refresh rate, and is often used in high-end display devices. High-temperature polycrystalline silicon TFT (HTPS TFT) is similar to LTPS, but is used at higher temperatures in the manufacturing process and is suitable for products with higher performance requirements. Low Temperature polycrystalline Oxide TFT (LTPO TFT) This material combines the benefits of LTPS and IGZO to provide lower power consumption and higher refresh rates. Zinc indium gallium oxide TFT (IGZO TFT) is known for its high electron mobility and low leakage current properties, making it suitable for high-performance and low-power display applications.

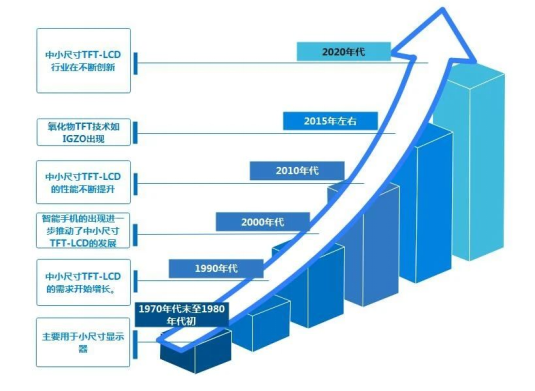

Small and medium-sized TFT-LCD industry development history

From the late 1970s to the early 1980s, TFT-LCD technology began to appear and gradually develop. Initially, the technology was mainly used for small displays, such as watches and calculators. In the 1990s, with the popularity of notebook computers and portable game consoles, the demand for small and medium-sized TFT-Lcds began to grow. During this period, Japanese companies such as Sharp, SONY and Toshiba took the lead in the TFT-LCD field. In the 2000s, the emergence of smart phones further promoted the development of small and medium-sized TFT-LCD. Especially after the release of the iPhone in 2007, high-quality displays with high resolution and high color saturation became the standard configuration of the mobile phone market, which prompted the rapid development of the entire industry. In the 2010s, with the continuous advancement of technology, including the development of different TFT technologies such as amorphous silicon (a-Si) and low-temperature polycrystalline silicon (LTPS), the performance of small and medium-sized TFT-LCD has been continuously improved, and the application range has also expanded from mobile phones to tablets, smart watches and other fields. Around 2015, oxide TFT technologies such as IGZO appeared, offering new options for small and medium-sized displays with their high electron mobility and low power consumption. In the 2020s, with the development of wearable devices and flexible display technology, the small and medium size TFT-LCD industry is also constantly innovating to meet the increasingly demanding market requirements.

Chart: Small and medium size TFT-LCD industry development history

Small and medium-sized TFT-LCD industry on the middle and downstream

The upstream industry of small and medium-sized TFT-LCD is mainly concerned with the supply of key materials such as glass formation and polishing materials, which are essential for the production quality and performance of panels. In the application industry, small and medium-sized TFT-LCD is widely used in many fields, mainly including mobile devices, consumer electronics, medical equipment, industrial control and automotive display. In the mobile device segment, which includes smartphones, tablets and wearables, small and medium size TFT-Lcds provide excellent visual effects and user experience with their high resolution, contrast and color saturation. Consumer electronics such as laptops, televisions and game consoles are also benefiting from small and medium size TFT-LCD technology to meet people's needs for high-quality images and video. In the field of medical equipment, the high resolution and excellent color reproduction ability of small and medium-sized TFT-LCD are used to provide accurate images and information display for doctors and patients, and improve the effect of medical diagnosis and treatment. In addition, there is growing demand for small and medium-sized TFT-Lcds in areas such as industrial control and automotive displays.

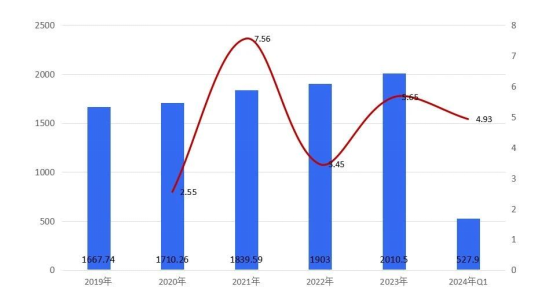

China's small and medium-sized TFT-LCD industry market size and growth rate

In 2022, China's small and medium-sized thin film transistor liquid crystal display (TFT-LCD) market reached a significant scale, with a total market value of 190.33 billion yuan. In terms of the geographical distribution of this market, South China ranked first with a share of 34.6%, showing its important position in the industry. It was followed by East China, which contributed a considerable portion of the industry with a market share of 21.65%. In terms of output, the production capacity of China's small and medium-sized TFT-LCD industry reached a level of about 19.135 million square meters in 2022, demonstrating the industry's strong capacity in terms of supply. At the same time, the demand is also performing well, about 11,972,300 square meters, revealing the market for small and medium-sized TFT-LCD products strong demand. The leading enterprises in China's small and medium-sized TFT-LCD industry include BOE, Hustar Optoelectronics and Innolutron, etc., which occupy a leading position in the market and have significant capacity advantages and technical strength. As the world's leading supplier of semiconductor display technology, products and services, BOE has deep technology accumulation and extensive market influence in the field of TFT-LCD, and continues to expand in the field of new display technologies such as OLED. TCL Huaxing Optoelectronics Technology (TCL Huaxing) focuses on the development and production of liquid crystal display panels, and its products are widely used in TV, mobile phones, tablet computers and other consumer electronics products, showing a strong market competitiveness. Innolux (InnOLUX), as a display technology company owned by Taiwan's Hon Hai Group, occupies an important position in the small and medium size TFT-LCD market with its strong R&D and production capabilities. In addition, as a professional design enterprise of liquid crystal display (LCD) and liquid crystal display module (LCM), Tianma Microelectronics mainly serves the fields of vehicle, medical, industrial control, etc., with its professional technology and market application experience, it has won wide recognition in the market. According to statistics from Zhiyan, the market size of China's small and medium-sized TFT-LCD industry in 2019 was 166.774 billion yuan, and the market size of China's small and medium-sized TFT-LCD industry in 2024 was 52.79 billion yuan, an increase of 4.93%. The market size of China's small and medium-sized TFT-LCD industry in 2019-2024Q1 is as follows:

Small and medium size TFT-LCD industry policy The development and implementation of small and medium size TFT-LCD industry policy aims to promote industrial technological progress, improve product quality and capacity scale to meet the growing market demand. In recent years, China, as a global consumer electronics manufacturing country, has introduced a series of development plans and industry policies in response to the industrial development bottleneck of "lack of core and less screen". These policies not only encourage enterprises to increase investment in research and development, promote the innovation and application of TFT-LCD technology, but also through financial subsidies, tax incentives and other measures to support enterprises to expand production scale and improve market competitiveness. At the same time, the policy also focuses on the coordinated development of the upstream and downstream of the industrial chain, promoting close cooperation in raw material supply, equipment manufacturing, application development and other links, and forming a complete industrial ecosystem.

Problems in the small and medium-sized TFT-LCD industry: With the popularity of electronic products such as smartphones, tablets, and wearable devices worldwide, the demand for small and medium-sized TFT-LCD panels has been growing rapidly. However, competition in the market is fierce. China's TFT-LCD manufacturers occupy an important position in the global market through economies of scale and cost advantages, resulting in particularly prominent price competition. This competitive pressure forces manufacturers in other countries and regions to seek technological innovation or transformation in order to remain competitive. At the same time, with the rise of new display technologies such as OLED (organic light-emitting diode), the market position of TFT-LCD panels is being challenged, especially in the high-end market. As consumers' requirements for display effects continue to increase, the small and medium-sized TFT-LCD industry needs continuous technological innovation to meet market demand. For example, high resolution, high refresh rate, low power consumption and thinness are the main trends at present. The advancement of these technologies requires huge investment in research and development and rapid capacity conversion, which is a huge challenge for small and medium-sized enterprises. In addition, with the development of flexible display technology, traditional TFT-LCD technology needs to be merged with it or replaced, which further increases the urgency of technology upgrades. TFT-LCD production process uses a lot of chemicals and energy, which has a certain impact on the environment. As the global awareness of environmental protection increases, the small and medium-sized TFT-LCD industry is facing increasingly stringent environmental regulations and standards. Companies need to invest in the upgrading and renovation of environmental protection facilities to reduce waste generation and emissions. At the same time, electronic waste disposal has become an increasingly serious problem, especially with the acceleration of product replacement, the disposal and recycling of waste electronic products has become more important. Therefore, how to achieve sustainable development while ensuring economic benefits is a problem that the small and medium-sized TFT-LCD industry must face.

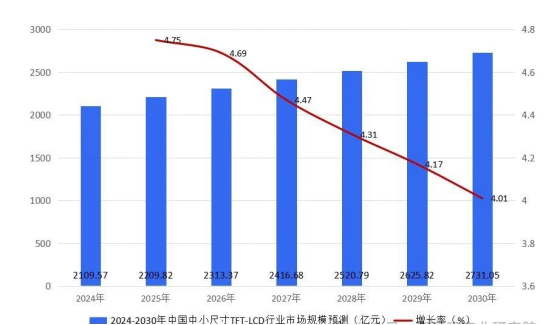

With the acceleration of global digitalization and intelligence trends, the demand for small and medium size TFT-LCD will continue to grow, especially in the fast-growing markets such as smartphones, smart wearable devices, and in-vehicle displays. Technological innovation will be a key factor driving the development of the industry, including improved resolution, reduced energy consumption, touch integration and the development of new display technologies (such as flexible display and 3D display), which will bring new growth points to the industry. In addition, with the breakthrough of domestic enterprises in core technologies and high-end manufacturing equipment, as well as the adaptation of environmental protection and sustainable development trends, China's small and medium-sized TFT-LCD industry is expected to occupy a more important position in the global market. However, companies also need to pay attention to the issue of price competition caused by overcapacity, as well as the possible impact of changes in the international trade environment on export markets. Overall, through technological innovation, market diversification and the optimization and upgrading of the industrial chain, the small and medium-sized TFT-LCD industry is expected to achieve sustainable and healthy development. According to the forecast of Zhiyan, 2024-2030 China's small and medium-sized TFT-LCD industry market size growth rate of 4%-5%, 2030 China's small and medium-sized TFT-LCD industry market size 273.305 billion yuan, an increase of 4.01%. The market size forecast of China's small and medium-sized TFT-LCD industry in 2024-2030 is as follows:

来源:智研瞻产业研究院